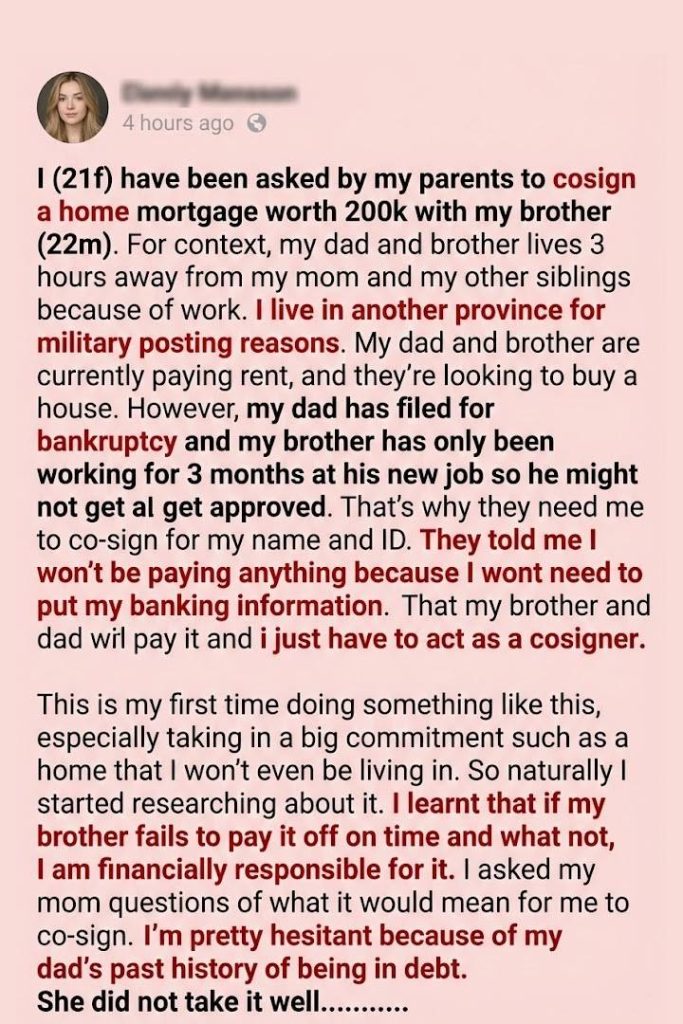

I’m 21 and have recently been asked by my parents to co-sign a home mortgage worth $200,000 for my brother, who is 22. For context, my dad and brother live three hours away from my mom and other siblings because of work, and I’m stationed in another province for my military posting. My dad and brother are currently paying rent, but they want to buy a house.

The reason they need me is that my dad has filed for bankruptcy in the past, and my brother has only been working for three months at his new job. Apparently, they might not get approved on their own. That’s why they want me to act as a co-signer — my name and ID would be on the mortgage, but they claim I wouldn’t need to contribute financially.

They assured me that I wouldn’t pay anything because my dad and brother would handle all the mortgage payments. In their words, I would just be “co-signing” on paper. Naturally, since this is my first time being involved in something like this, I started doing some research on what co-signing actually means.

During my research, I learned that co-signing is more than just a formality. A co-signer is legally responsible for the loan if the primary borrowers fail to pay. Even if my brother and dad promised to make all payments, the bank would hold me accountable if they defaulted. This could affect my credit score, my ability to rent, or even my future loans.

I also discovered that missed payments or defaulted loans would appear on my credit report. That means any future financial plans, like buying a house, applying for a car loan, or even taking out a personal loan, could be compromised. Suddenly, a favor that seemed simple became a potential risk to my entire financial future.

Considering my dad’s past bankruptcy, I became even more hesitant. Bankruptcy indicates a history of financial mismanagement or difficulty repaying debts, which makes relying on him and my brother for the mortgage riskier. My brother’s short employment history also concerns me — banks usually like to see a stable work record before approving a mortgage.

I decided to discuss my concerns with my mom, asking specific questions about what it would mean to co-sign and what the potential consequences could be. I wanted to make sure I fully understood the responsibility before committing.

Unfortunately, my mom did not take my questions well. She seemed frustrated and implied that I was overthinking things or being unsupportive. This added emotional pressure on top of the practical concerns, which made the decision even more stressful.

It’s important to understand that being a co-signer is not a risk-free favor. While your family may promise to handle payments, life can be unpredictable. Job loss, medical emergencies, or other financial struggles could cause missed payments, leaving the co-signer liable.

Another consideration is that as a co-signer, I would not gain ownership or equity in the property unless the mortgage is paid and the house is legally transferred to me. Essentially, I would be risking my credit and financial stability without any benefit.

Some alternatives could include helping my family save for a larger down payment, assisting them in finding lenders who specialize in first-time buyers, or even helping them explore government programs for people with poor credit. These options could provide support without exposing me to huge financial risk.

It’s okay to say no, even to family. Saying no does not make you unsupportive or ungrateful — it means you’re protecting your own financial future. Co-signing a mortgage is a huge responsibility, and anyone who pressures you to take on that risk is ignoring your rights and well-being.

If you do consider co-signing, there are ways to mitigate risk: formal legal agreements, proof of monthly payments, and understanding your own budget in case you’re ever held responsible. However, these steps do not eliminate the inherent risk of co-signing, especially with a high-value mortgage.

Ultimately, my situation highlights the importance of financial education and understanding your rights before making major commitments. Being informed gives you the power to protect yourself while still supporting your family in responsible ways.

In conclusion, co-signing a mortgage for a family member may feel like a simple favor, but it carries long-term financial consequences. Given my dad’s bankruptcy history and my brother’s short employment record, I have serious reservations. Protecting my credit, future, and financial stability is not selfish — it is necessary. Saying no, or finding safer ways to help, is a responsible choice.